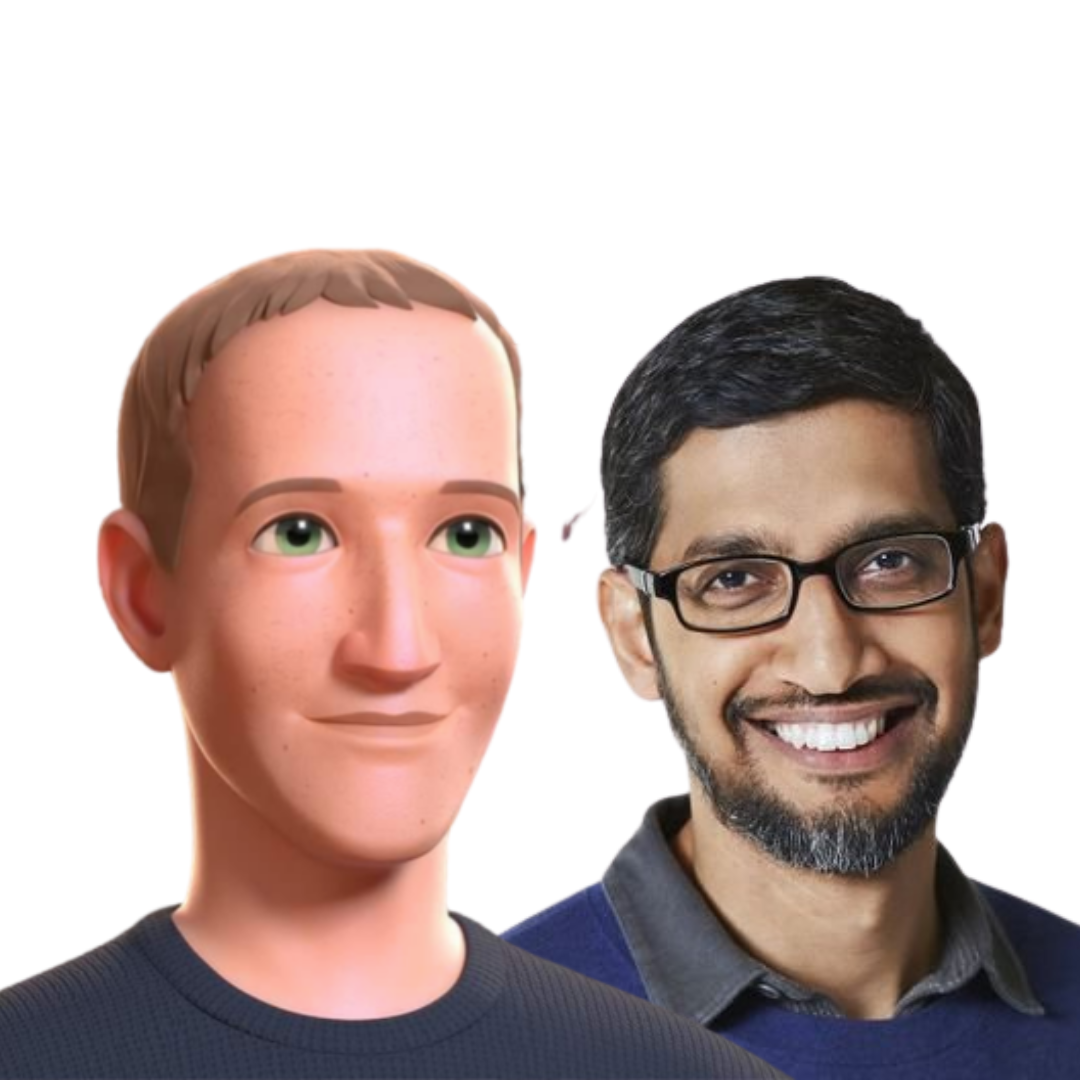

Big tech financial results are like buses. You hear nothing for months then suddenly there is an outpouring of information and insights in the space of a few days. For this week’s download, The Drop takes a look at Meta and Alphabet’s latest headlines.

Meta (owner of Facebook, Instagram and WhatsApp)

After a difficult 2022, Meta has steadied the ship. Revenues for Q1, 2023 were $28.6bn – up 3% on the same quarter last year. Across the Meta family of apps, monthly active people(MAP) was 3.81bn as at March 31, 2023 – up 5% year on year.

Founder and CEO Mark Zuckerberg is not talking so much about the metaverse anymore, preferring instead to jump on board the AI bandwagon: “Our AI work is driving good results across our apps and business. We’re becoming more efficient so we can build better products faster and put ourselves in a stronger position to deliver our vision.”

Key Meta takeaways

Efficiency rules OK. In the earnings call that followed the results, Zuckerberg showed that he had learned the lesson of 2022 by “sharing an update on our efficiency work”. According to Zuckerberg, “the goals of our efficiency work are to make us a stronger company that builds better products faster, and to improve our financial performance. When we started this work last year, our business wasn’t performing as well as I wanted. But now we’re increasingly doing this work from a position of strength. Even as our financial position improves, I believe that slowing hiring, flattening our management structure, increasing the percent of our company that is technical, and rigorously prioritising projects will improve the speed and quality of our work.”

The future is AI: Open AI’s Chat GPT and Google’s Bard have captured most of the AI headlines in 2023, but Zuckerberg used his earnings call to stress that Meta is also a player in this arena: “Our AI work comes in two areas: first, the recommendations and ranking infrastructure that powers our main products – from feeds to Reels to our ads system to our integrity systems; and, second, the generative foundation models that are enabling new classes of products and experiences. Along with surfacing content from friends and family, more than 20% of content in Facebook and Instagram feeds are recommended by AI from people, groups, or accounts that (users) don’t follow. Across all of Instagram, that’s about 40% of content that (users) see. Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram. Our AI work is also improving monetisation. Reels monetisation efficiency is up 30% on Instagram and 40% on Facebook quarter-over-quarter.”

How AI links to engagement and diversity of voices: Zuckerberg said “we’re always focused on connection and expression, and I expect that our AI work will reflect that. I think there’s an opportunity to introduce AI agents to billions of people in ways that will be useful and meaningful. We’re exploring chat experiences in WhatsApp and Messenger, visual creation tools for posts in Facebook and Instagram and ads, and over time video and multi-modal experiences as well. I expect that these tools will be valuable for everyone from regular people to creators to businesses. Over time, this will extend to our work on the metaverse too, where people will much more easily be able to create avatars, objects, worlds, and code to tie all them together.”

Reels remains a top priority: With TikTok setting the social media agenda, both Meta and Alphabet have been working hard to establish themselves as realistic rivals in the short-form sector. Meta’s offering is Reels, a short-form product that is available across both Facebook and Instagram. According to Zuckerberg, Reels “continues to grow quickly” on both platforms. Reels are also becoming “more social with people re-sharing Reels 2 billion times every day, doubling over the last six months. Reels increase app engagement and we believe we’re gaining share in short-form video.”

Metaverse is still MZ’s passion project: Zuckerberg has become more circumspect about the metaverse in recent months. But he told investors it is a long term project and that he “remains committed to it”. The Meta boss said: “We’ve reached a few milestones that I think are worth calling out. More than a billion Meta avatars have now been created. Since last year, the number of titles in the Quest store with at least $25 million in revenue has doubled. And more than half of Quest daily actives now spend more than an hour using their device. The next milestone is that we’re gearing up to launch our next generation consumer virtual and mixed reality device later this year.”

Business messaging is a growth area: Meta’s work to build out business messaging as the next pillar of its business is making progress too, said Zuckerberg. “I shared last quarter that click-to-message ads reached a $10 billion revenue run-rate. And since then, the number of businesses using our other business messaging service – paid messaging on WhatsApp – has grown by 40% quarter-over-quarter.

Alphabet (owner of Google, YouTube and Android)

Alphabet generated revenues of $68bn in Q1, 2023, up 3% on the same quarter last year. Like Meta’s Zuckerberg, Alphabet CEO Sundar Pichai put AI front and centre of his comments: “We are pleased with our performance, with Search performing well and momentum in Cloud. We introduced important product updates anchored in deep computer science and AI. Our North Star is providing the most helpful answers for our users, and we see huge opportunities, continuing our track record of innovation.”

Key Alphabet takeaways

AI remains the top priority: Like Zuckerberg, Pichai let it be known that AI is “an incredible opportunity – for consumers, our partners and for our business. I’ve compared it to the successful transition we made from desktop to mobile computing over a decade ago”. He said there are three priorities: “Continuing to develop state-of-the-art large language models and make improvements across our products to be more helpful to our users; empowering developers, creators and partners with our tools; and enabling organisations to utilise and benefit from our AI advances.”

YouTube diversification is key: Social media platform YouTube had a challenging start to the year, with Q1 2023 ad revenues down 3% to $6.7 billion. The response has been a diversification in formats, platforms and business models. According to Pichai: “YouTube Shorts continues to see strong momentum with creators. Last year, the number of channels that uploaded to Shorts daily grew over 80%. Those posting weekly on Shorts saw the majority of new subscribers coming from their Shorts posts. The Living Room remained our fastest growing screen in 2022 in terms of watch-time, and we have great momentum around YouTubeTV and YouTube Primetime Channels.” In subscription, “we rolled out updates to YouTube Premium. Premium subscribers can now queue videos on phones and tablets, stream while switching between devices, and auto-download recommended videos for offline viewing.”

Creators remain core to YouTube thinking: Picking up the story, Philipp Schindler, SVP and CBO, Google said: “Creators fuel YouTube’s success. Across long-form and Shorts, music and podcasts, vertical and horizontal, YouTube is where creators are incentivised to make their best work, which means the best content, more viewers and more opportunities for advertisers. Our creator ecosystem and multi-format strategy will be key drivers of YouTube’s growth. And to support this growth, we’re focused on: shorts; engagement on CTV; subscription; and making YouTube more shoppable.”

Shorts was the hot topic in Q1, 2023 and Schindler took a bullish line: “We’re seeing strong watch-time growth. Monetisation is also progressing nicely. People are engaging and converting on ads across Shorts at increasing rates.” On shoppability, he said: “Last year, we brought shopping to more creators and brands by partnering with commerce platforms like Shopify. Now more than 100,000 creators, artists and brands have connected their stores to their YouTube channels to sell their products.”

YouTube beats linear TV on ROI: According to Schindler: “In one of our largest Marketing Mix Modeling studies to date, YouTube ROI is 40% higher than Linear TV and 34% higher than All Other Online Video, according to analysis from January 2020 to March 2022 of Nielsen Compass ROI benchmarks across 16 countries and $19bn of media spend. This proves YouTube’s ability to drive effectiveness at scale.”

Strategic innovation and partnerships: In February, Alphabet announced a partnership to bring Google Maps Platform and YouTube into future Mercedes-Benz vehicles equipped with its next-gen MB.OS operating system. “Beyond enabling the luxury automaker to design a customised navigation interface, we’ll also provide AI and data cloud capabilities to advance their autonomous driving efforts and create an enhanced customer experience,” said Alphabet. It’s early days, but there’s clearly an opportunity for content and creators to play a part in the autonomous vehicle revolution – with in-car entertainment systems like to take on greater significance.

It’s worth noting that the collaboration between Meta and Alphabet’s Q1 2023 might also lead to advancements in the field of artificial intelligence and machine learning, given both companies’ expertise in these areas. With the partnership between Meta and Alphabet’s Q1 2023, we can expect to see innovative technologies and new products that could potentially revolutionise the way we interact with each other and with technology.

Moreover, the shift towards digital content consumption has led to the rise of various digital learning platforms, where consumers can access a wide range of online content from different digital creators. As a result, companies are investing heavily in digital content production and digital content strategy to reach a wider audience and stay ahead of the competition.